Max Amount For Fsa In 2025

Max Amount For Fsa In 2025. Keep reading for the updated limits in each category. Here, a primer on how fsas work.

2025 fsa maximum carryover amount: As anticipated, the maximum employee contribution to health fsas will be $3,200 for taxable years beginning in 2025, up $150 from 2025.

Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

As anticipated, the maximum employee contribution to health fsas will be $3,200 for taxable years beginning in 2025, up $150 from 2025.

Irs List Of Fsa Eligible Expenses 2025 Rorie Claresta, Fsas only have one limit for individual and family health. For 2025, the maximum adoption assistance limit increases to $16,810.

Fsa Approved Items 2025 Image to u, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). Fsas only have one limit for individual and family health.

.png)

Limited Purpose Fsa Contribution Limits 2025 Tess Abigail, For fsas that allow carryover of unused amounts, the maximum for 2025 to 2025 is $640, up from $610 that can be carried over from 2025 to 2025. For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2025.

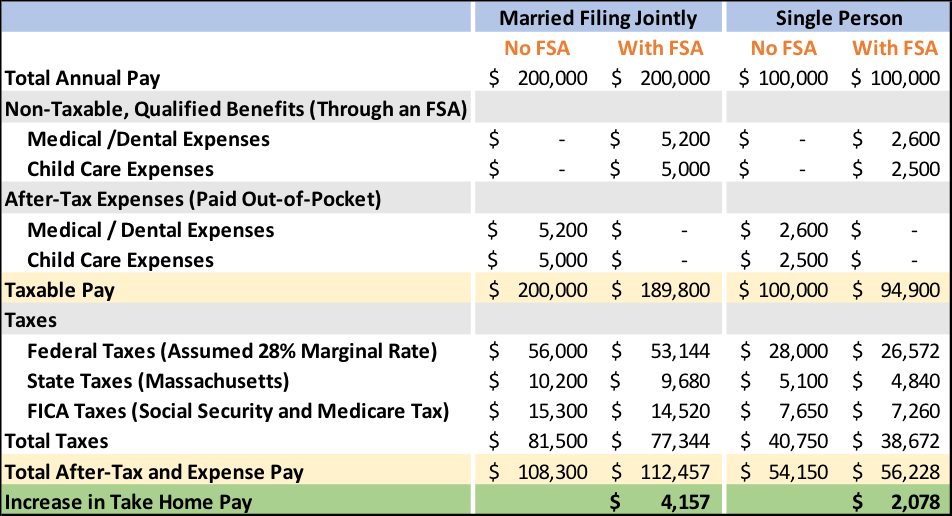

Has Irs Announced Fsa Limits For 2025 Jany Blancha, That’s up from $15,950 in 2025. The maximum dcfsa election is $5,000 per household.

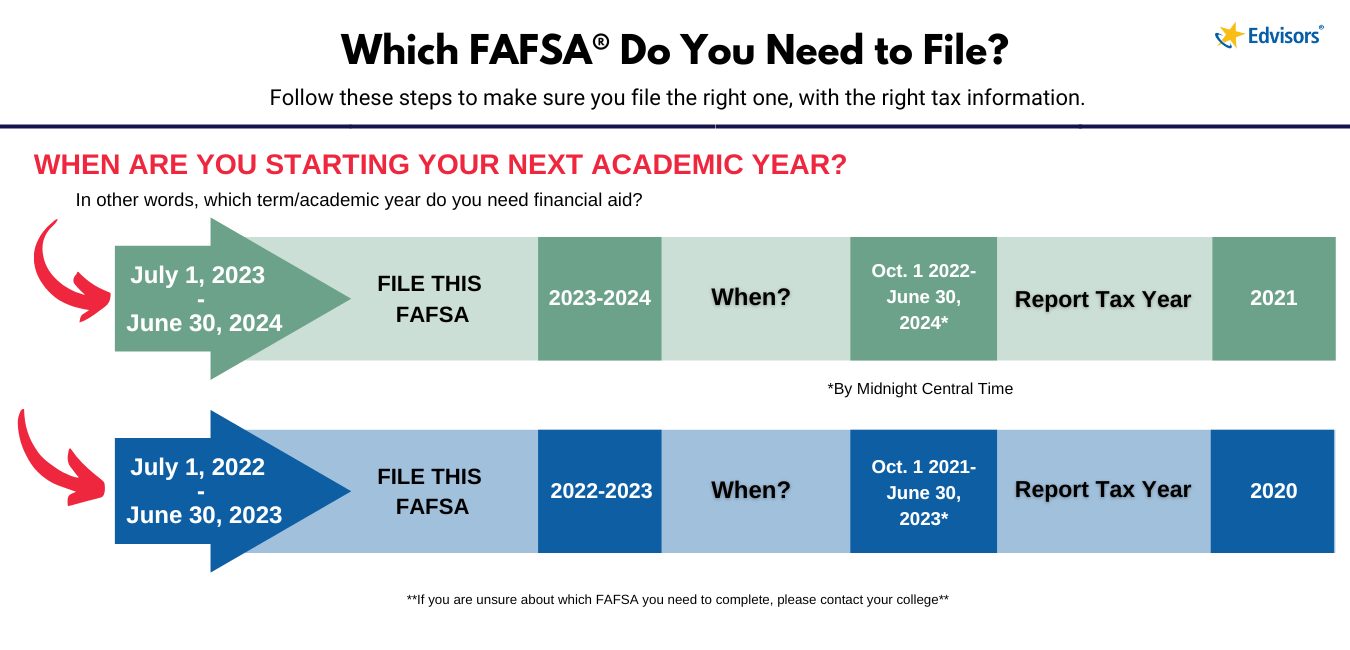

When is the FAFSA Deadline 20232024? Edvisors, Fsa plan participants can carry over up to $640 from 2025 to 2025 (20% of the $3,200 fsa maximum contribution for. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

S3Ep1 2025 FSA Limits M3 Insurance, Because of the american rescue plan signed into law in march 2025, the contribution limit has been raised to $5,500 for married couples filing jointly or $2,750 for. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Health FSA Limit Set to Increase for 2025, For 2025, the maximum adoption assistance limit increases to $16,810. Employer assistance remains completely excludable.

![How FSAs Work and What They Cover [2025] FinanceBuzz](https://images.financebuzz.com/2304x1215/filters:quality(75)/images/2021/01/28/fsa-account.jpeg)

2025 Contribution Limits Announced by the IRS, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2025.

How FSAs Work and What They Cover [2025] FinanceBuzz, What is the 2025 maximum fsa contribution? For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2025.

Flexible Spending Accounts A Useful Employee Benefit That Can Reduce, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).